How Simplii and The Motley Fool Use In-Product Messaging for Seamless Experiences that Increase Adoption

Published on October 30, 2024/Last edited on October 30, 2024/5 min read

Team Braze

Consumers have more choices and more ways to engage with financial services providers than ever before. However, while 82% of financial services companies say their audiences are satisfied with their messaging experience, only 41% of consumers agree. To learn how to close that gap, Brian Laker, Senior Director of Industry Marketing at Braze, chatted with Joseph Orsini, Director of Personalization and Digital Sales at Simplii Financial, and Ashley Reeder, Senior Product Manager at The Motley Fool about how they use in-product channels to connect effectively with consumers and their individual journeys. Let’s get into what they had to say about the impact and advice for marketers.

Why In-Product Messaging Matters

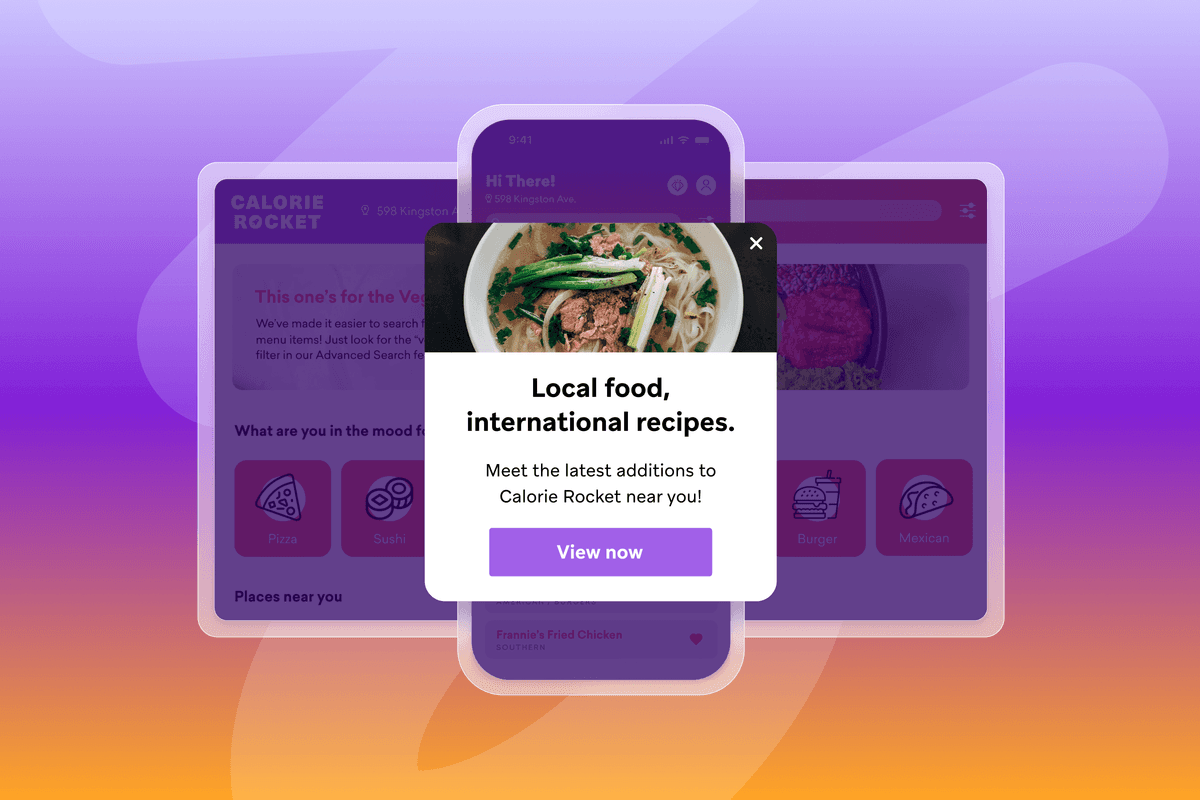

Imagine receiving an email from your bank about a limited-time offer on a new savings account with a higher interest rate. You click on the email taking you to the app, but you’re greeted by the generic homepage displaying your account balance and are confused about where to go next. That’s an example of the fragmented experience consumers receive when in-product messaging isn’t connected to the rest of your marketing.

What is in-product messaging? In-product messaging channels reach individuals who are actively engaging with your website or mobile app. They are useful for driving specific actions in your website or app. Think: a website banner highlighting a new feature, an in-app survey asking about your financial goals, an app inbox storing all of your personalized offers.

In-product messaging is the solution to avoid these types of fragmented experiences, and it has other advantages as well. In addition to making experiences more seamless, it’s a channel that every app user is opted into, and it allows marketers to deliver timely messages at the right moment. Joseph said “By meeting clients where they are, in-product channels can help build stronger relationships and attract more profitable customers. This can ultimately help to differentiate a brand in a competitive market.”

Ashley added that “in-product channels are also excellent for collecting zero-party data and surveying customer satisfaction. It turns out customers are more than willing to share information in the moment if it can lead to greater personal financial success.”

How Simplii and The Motley Fool improved adoption with In-Product Messaging

Now let’s explore how Simplii Financial and The Motley Fool successfully implemented these strategies to improve customer engagement.

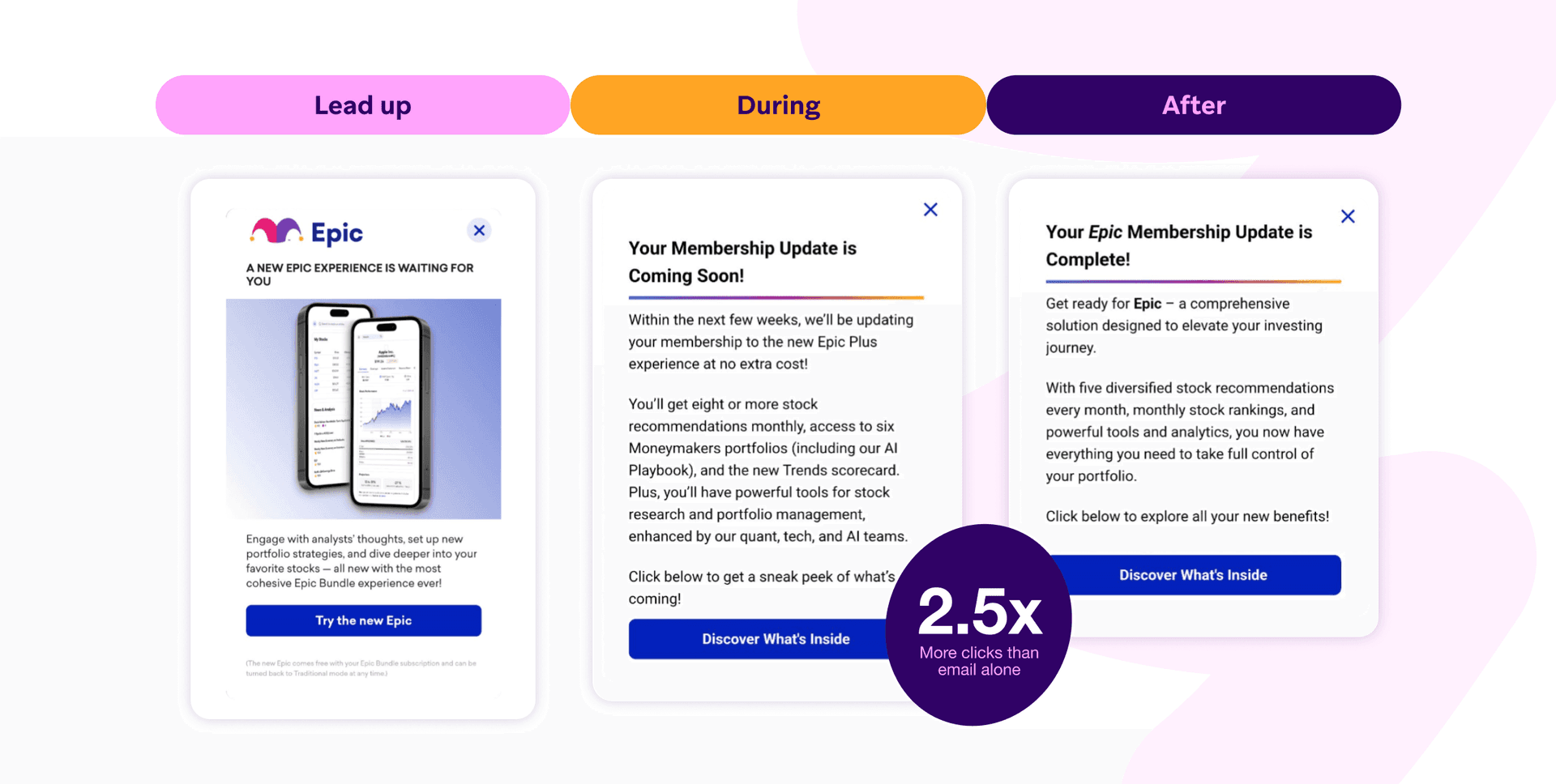

The Motley Fool

The Motley Fool recently released their biggest member upgrade ever which included a new site experience, improved tools, and a simplified suite of products. To help customers get the most value from the update, they used in-product channels (Braze in-app messages) to create a seamless transition experience, mitigate email fatigue, and provide timely support. The Motley Fool wanted to inform customers eligible for their new Epic Plus experience leading up to, during, and after the transition. Their in-app messaging resulted in 2.5X more clicks than email alone.

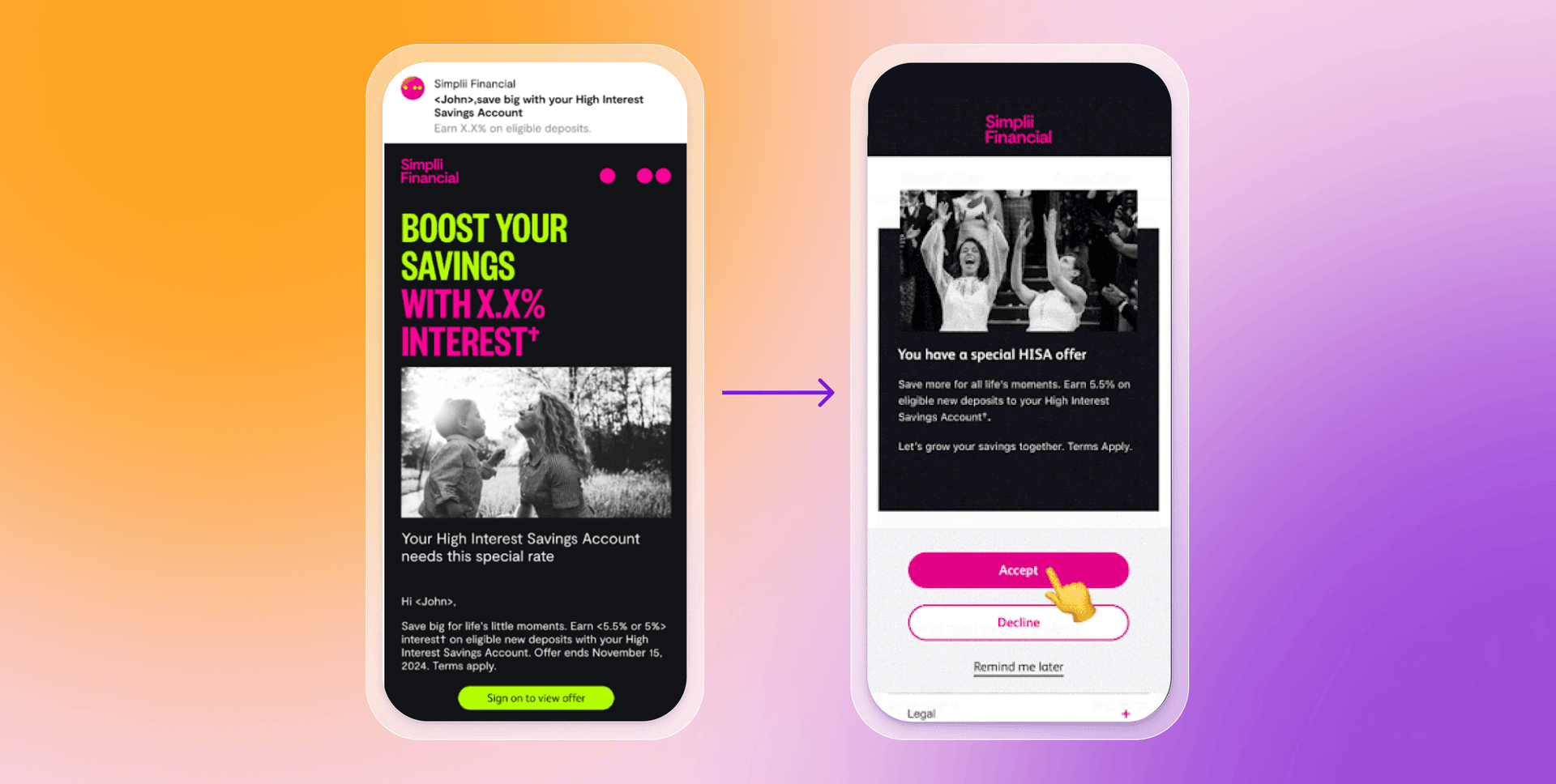

Simplii

Simplii used in-product channels to present a hyper-targeted savings offer intended to increase users’ overall balance. When clients onboarded that already had an existing savings account, they were sent messages notifying them of Simplii’s savings interest offer. They used email, push notifications and SMS to illustrate the difference in percentages offered for qualified segments. Using this cross-message strategy, clients were able to enroll in the promotion offer in two clicks. From there, Simplii sent in-app messages and Content Cards to real-time, relevant information such as the exact expiration, terms and conditions, and if the offer had been activated properly. The campaign drove 15% forecasted growth in balances—representing a 99% increase in overall enrollments, compared to prior campaigns.

Advice for Marketers Looking to Leverage In-Product Messaging

For marketers at financial service companies not currently utilizing in-product messaging, Joseph and Ashley offered some practical advice.

- Believe in the value: It can be challenging to align matrixed teams such as developers, designers, marketing, and leadership. To get internal buy-in, you may need to demonstrate ROI through case studies and pilot results when possible. But Ashley said, “when it all comes together, it’s magic and there’s an aha moment across all of these teams.”

- Start Small: Both Joseph and Ashley agreed that you should start with some smaller opportunities and test gradually into more challenging opportunities. To do this, start with a well-defined audience and objective. Keep in mind that you should aim for a non-intrusive experience and target qualified users based on their actions and behaviors.

- Test and Learn: If you have a clear audience and objective, you should be able to monitor performance. Continuously track the effectiveness of your in-product messages and use analytics to understand what works and what doesn’t, and adjust your strategy accordingly.

Final Thoughts

As the financial services landscape continues to evolve, those who leverage in-product messaging will be well-positioned to thrive in an increasingly competitive environment. So, take the plunge and explore how in-product channels can elevate your customer engagement efforts today.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article13 min read

Article13 min readBraze vs Salesforce: Which customer engagement platform is right for your business?

February 19, 2026 Article18 min read

Article18 min readBraze vs Adobe: Which customer engagement platform is right for your brand?

February 19, 2026 Article7 min read

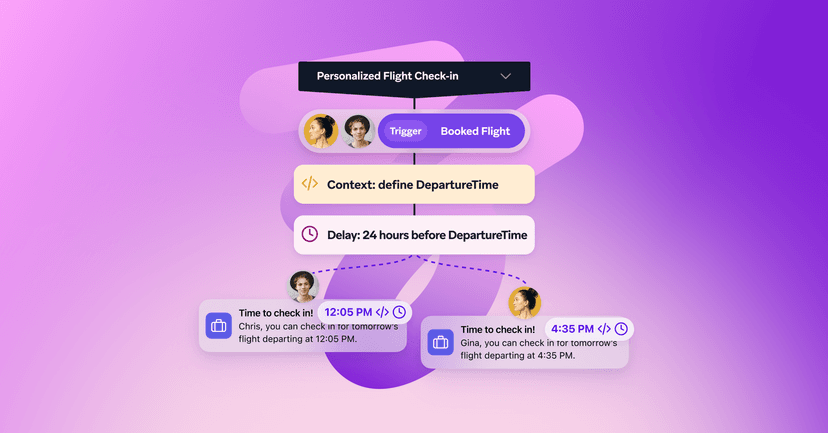

Article7 min readEvery journey needs the right (Canvas) Context

February 19, 2026