3 min read

Payomatic Boosts Mobile App Adoption and Lifetime Value with Data-Driven Marketing

Check-cashing and financial services provider Payomatic wanted to evolve its traditional brick-and-mortar business model to go digital. To support this digital transformation, the company was looking to add cross-channel, 1:1 customer engagement capabilities to augment existing marketing efforts.

Payomatic used Braze in tandem with Snowflake to reach customers at the right stage in the customer journey with push notifications, in-app messages, Content Cards, and Connected Content.

Payomatic’s use of Braze drove a 32% uplift in direct deposit adoption via its mobile app.

INDUSTRY

PRODUCTS USED

BY THE METRICS

32%

Lift in direct deposit adoption via app

11%

Increase in mobile app engagement

50%

Prepaid cardholder mobile app penetration

Since the 1950s, Payomatic has provided check cashing services, money transfers, money orders, bill payments, prepaid debit cards and a variety of other convenience services to New York City residents. In the past, Payomatic reached out to customers primarily through advertising and in-store cross-selling. Braze helped Payomatic take its marketing messages directly to consumers, encouraging them to engage in high-value activities such as enrolling in direct deposit, reloading prepaid cards, and sending money to friends and family.

The key to Payomatic’s new approach was personalized marketing, leveraging the wealth of data at their disposal about what customers do in stores, within the mobile app, and through payment networks. This data-driven strategy helped Payomatic derive insights and results much faster, and use those results to drive and improve future campaigns.

How Data Drives Better Insights and App Adoption

Payomatic used Braze together with Snowflake, the cloud data warehouse, to centralize customer data in one location. With easy integration of their data, Payomatic’s engineering team was able to avoid building complicated ETL processes or dealing with the many data management headaches that are frequently encountered when storing data on legacy systems. With a cloud-based, 360-degree view of their customers, Payomatic can more easily launch effective campaigns that engage and retain customers.

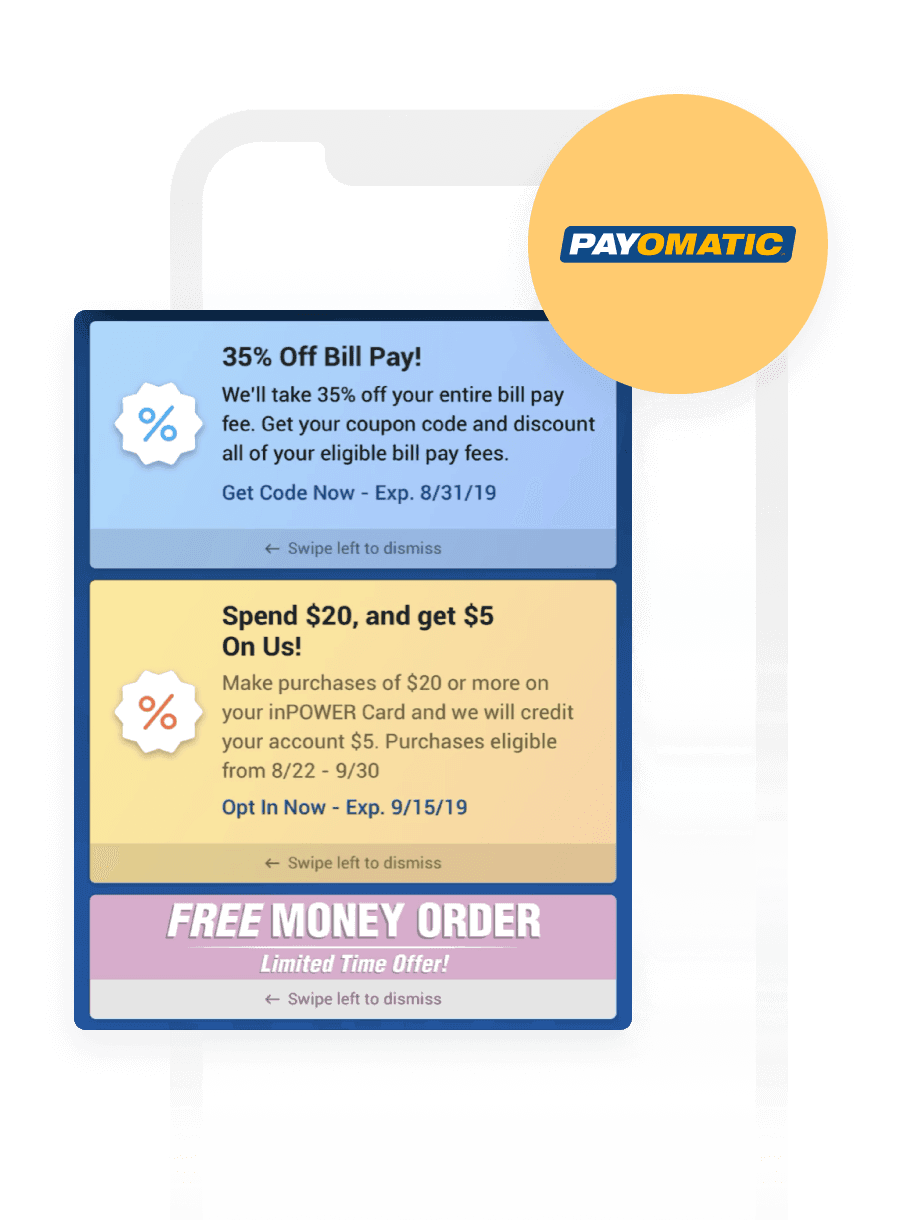

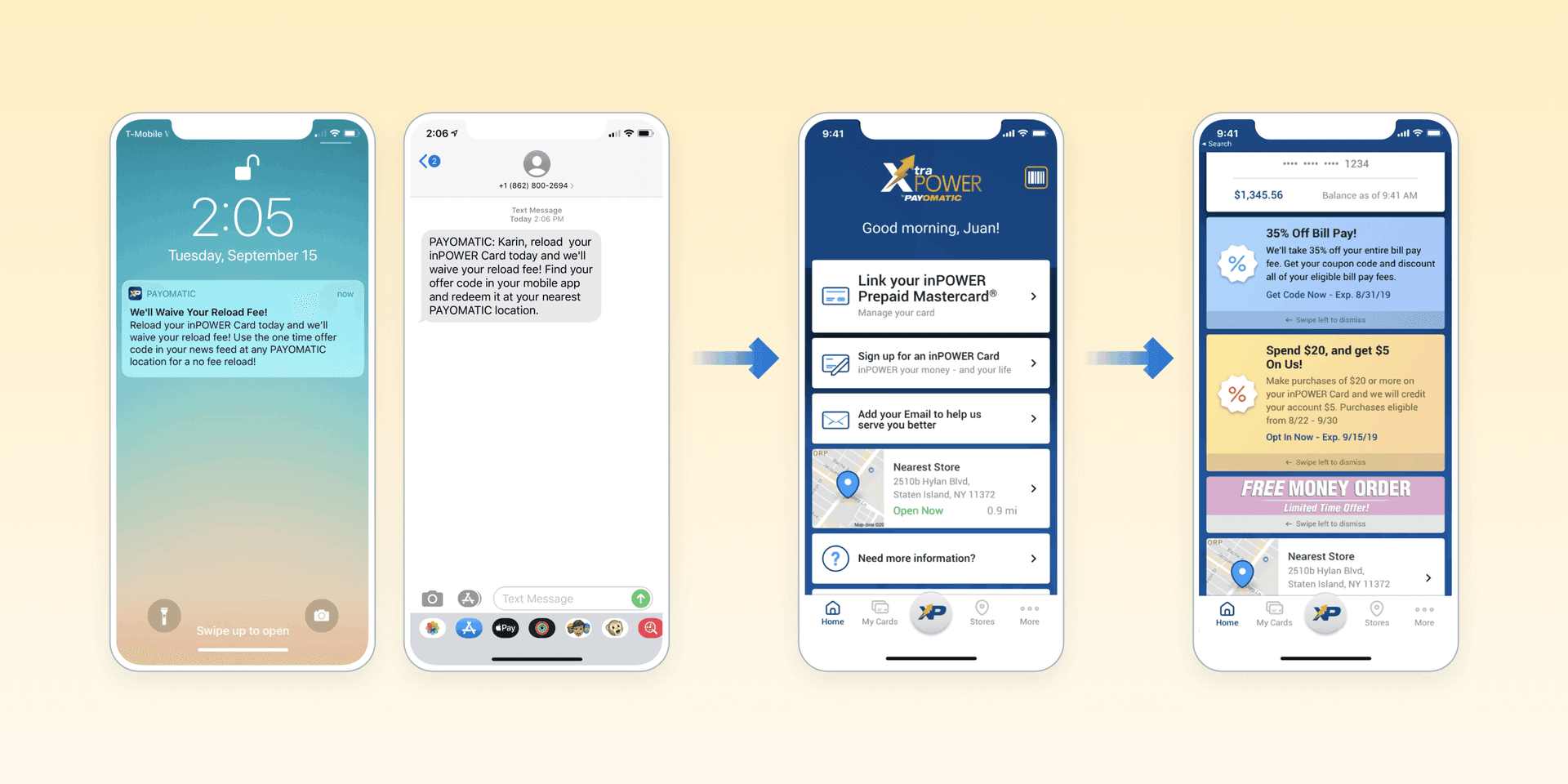

To guide customers through the Payomatic journey, including downloading the mobile app, the company sent push notifications to drive traffic to Content Cards within the mobile app—which, in turn, would trigger in-app messages offering personalized offer codes or deep links to direct deposit forms. Payomatic also sent customer emails and in-app messages to support onboarding and reengagement campaigns, using Braze Connected Content to dynamically update message content via API.

This focus on personalization continues through Payomatic’s integration with AWS SageMaker to apply machine learning to data within Snowflake, supporting user segmentation for even more refined personalization. On top of that, Payomatic also partnered with Fivetran to replicate data from different sources into Snowflake, ensuring that campaigns can rely on the freshest information about customers.

Because we now rely on a cloud-based, 360-degree view of our customer, we’ve become much better at collecting actionable insights that improve future campaigns and help us increase customer lifetime value.

Steven Mayotte

CIO of Payomatic

Payomatic Results: Uplift in Direct Deposits and Mobile App Adoption

By reaching out to customers directly to guide them along their financial journey, Payomatic generated higher adoption and engagement for its mobile app and increased customer lifetime value. Customers are being onboarded more effectively, engaging with the app more often, and converting to more high-value behaviors.

Key Takeaway

When you get to know your customers inside and out, your marketing messages really hit home—as Payomatic discovered when it tapped customer data to personalize push notifications, Content Cards, and in-app messages. Using Snowflake and Braze, the company can now centralize and analyze in-the-moment customer data, engage customers with personal messages at the right stage in their journeys, boost adoption of its digital tools, and increase customer lifetime value. As Payomatic undergoes its forward-looking digital transformation, the company is better positioned than ever before to help its customers go digital to better manage their financial needs.

To build your own data-driven approach to customer engagement, learn about using Braze and Snowflake to unlock the potential of data sharing.